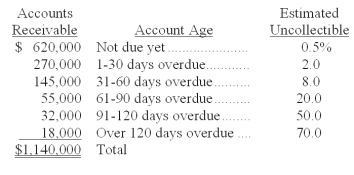

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:  Required:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c. Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Modern Reflexivity

The capacity of modern societies to think about, analyze, and adapt their traditions and institutions in the light of new information or challenges.

Large-Scale Social Institutions

Organized, established systems in society that govern the behavior and expectations of individuals within a community.

Similar Processes

Refers to analogous methods or sequences of actions that occur in different contexts but produce comparable outcomes or effects.

Fast Food

A type of mass-produced food designed for commercial resale and with a strong priority placed on "speed of service" over other quality factors.

Q36: Helix Co. entered into the following transactions

Q46: A company had net sales of $500,000

Q69: The aging method of determining bad debts

Q84: A company had the following purchases during

Q87: Separation of duties divides responsibility for a

Q101: The direct write-off method of accounting for

Q111: _ are additional costs of plant assets

Q122: A subsidiary ledger:<br>A) Includes transactions not covered

Q165: The difference between the amount borrowed and

Q193: The current FUTA tax rate is 0.8%,