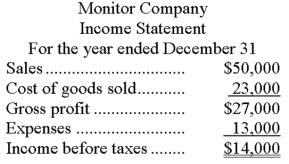

Monitor Company uses the LIFO method for valuing its ending inventory. The following financial statement information is available for its first year of operation:  Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been, had Monitor used the FIFO method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax rate?

c. If Monitor wanted to lower the amount of income taxes to be paid, which method would it choose?

Definitions:

Ventricular Tachycardia

A fast heart rhythm that originates from the ventricles, potentially leading to serious heart conditions.

Atrial Fibrillation

A cardiac arrhythmia characterized by rapid, irregular beating of the atria, leading to decreased blood flow and risk of stroke.

Dyspnea

The sensation of breathlessness or difficulty in breathing, often experienced as a symptom of a health condition.

Airway Compromise

A situation where the airway is partially or completely obstructed, leading to reduced or blocked airflow.

Q8: An inventory error is sometimes said to

Q54: The principles of internal control include:<br>A) Establish

Q56: Fun Land Toy Stores has taken a

Q86: An account used in the periodic inventory

Q108: Using the retail inventory method, if the

Q122: Two common subgroups for liabilities on a

Q137: Regardless of the inventory costing system used,

Q175: The Sun Company completed the following sales

Q180: The cash basis of accounting recognizes revenues

Q181: Using the information given below, prepare general