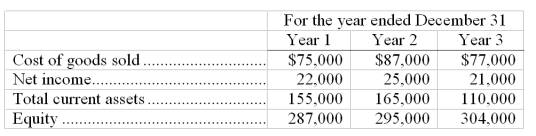

The City Store reported the following amounts on their financial statements for Year 1, Year 2, and Year 3:  It was discovered early in Year 4 that the ending inventory on December 31, Year 1 was overstated by $6,000, and the ending inventory on December 31, Year 2 was understated by $2,500. The ending inventory on December 31, Year 3 was correct. Ignoring income taxes determine the correct amounts of cost of goods sold, net income, total current assets, and equity for each of the years Year 1, Year 2, and Year 3.

It was discovered early in Year 4 that the ending inventory on December 31, Year 1 was overstated by $6,000, and the ending inventory on December 31, Year 2 was understated by $2,500. The ending inventory on December 31, Year 3 was correct. Ignoring income taxes determine the correct amounts of cost of goods sold, net income, total current assets, and equity for each of the years Year 1, Year 2, and Year 3.

Definitions:

Q4: Managers place a high priority on internal

Q15: Peg had net sales of $28,496 million,

Q30: Permanent accounts include all of the following

Q49: How is a classified balance sheet different

Q90: On a bank statement, deposits are shown

Q92: _ refers to the programs that help

Q116: When purchase costs of inventory regularly decline,

Q149: The following information has been gathered for

Q175: Purchase discounts are the same as trade

Q187: An overstatement of ending inventory will cause