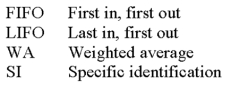

Identify the inventory valuation method that is being described for each situation below. In all cases, assume a period of rising prices. Use the following to identify the inventory valuation method:  a. The method that can only be used if each inventory item can be matched with a specific purchase and its invoice.

a. The method that can only be used if each inventory item can be matched with a specific purchase and its invoice.

b. The method that will cause the company to have the lowest income taxes.

c. The method that will cause the company to have the lowest cost of goods sold.

d. The method that will assign a value to inventory that approximates its current cost.

e. The method that will tend to smooth out erratic changes in costs.

Definitions:

U. S. Treasury Bills

Short-term government securities issued by the United States Department of the Treasury with maturity periods of one year or less.

Internal Control Environment

The overall structure, policies, and procedures implemented by a company to ensure the integrity of financial reporting, compliance with laws, and effective operations.

Monitoring Policies

The procedures implemented to continuously review and ensure that practices and activities within an organization comply with laws, regulations, and internal standards.

Cost-Benefit Considerations

The process of comparing the costs and benefits of a decision, project, or investment to assess its feasibility or profitability.

Q5: Revenues, expenses, withdrawals, and Income Summary are

Q30: Williams Company began business on May 1.

Q95: At the end of the current period,

Q101: Net realizable value for damaged or obsolete

Q127: A company's internal control system:<br>A) Eliminates the

Q134: Credit terms of 2/10, n/30 imply that

Q147: The amount recorded for merchandise inventory includes

Q166: A merchandising company's _ begins with the

Q189: A company's cost of inventory was $317,500.

Q191: Effective cash management involves applying all of