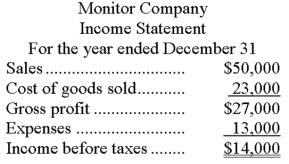

Monitor Company uses the LIFO method for valuing its ending inventory. The following financial statement information is available for its first year of operation:  Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been, had Monitor used the FIFO method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax rate?

c. If Monitor wanted to lower the amount of income taxes to be paid, which method would it choose?

Definitions:

Marginal Revenue

The increased earnings a business obtains from the sale of one extra unit of goods or services.

Maximizing Profits

The process by which a firm adjusts its production to achieve the highest possible profit.

Metropolitan Opera

A leading American opera company based in New York City, known for its live performances and international broadcasts.

Perfect Competitor

A perfect competitor refers to a market participant in a perfectly competitive market, characterized by many buyers and sellers, all dealing in a homogenous product with no barriers to entry or exit.

Q10: The _ principle requires that an accounting

Q13: In order to streamline the purchasing process,

Q48: A company has net sales and cost

Q89: Adjusting entries:<br>A) Affect only income statement accounts.<br>B)

Q90: The following statements are true regarding the

Q104: Closing entries result in net income or

Q114: On December 31, a company needed to

Q140: _ is the use of electronic communication

Q163: The following information is available for the

Q174: All plant assets, including land, eventually wear