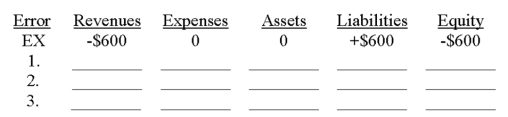

Given the table below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements, and a "0" for no effect. The first one is done as an example.

Ex. Failed to recognize that $600 of unearned revenues, previously recorded as liabilities, had been earned by year-end.

1. Failed to accrue salaries expense of $1,200.

2. Forgot to record $2,700 of depreciation on office equipment.

3. Failed to accrue $300 of interest on a note receivable.

Definitions:

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, calculated before the period begins based on estimated costs.

Machine-Hours

A measure of the amount of time that a machine is operated, used as a basis for allocating manufacturing overhead.

Variable Manufacturing Overhead

The portion of overhead costs that varies with production volume, including utilities and indirect labor expenses related to manufacturing.

Fixed Manufacturing Overhead

Costs in manufacturing that do not vary with the level of production output, such as salaries of managers and depreciation of factory equipment.

Q14: On October 1, Courtland Company sold merchandise

Q31: Adjusting entries result in a better matching

Q64: The matching principle requires that expenses get

Q95: All of the following regarding reversing entries

Q107: Identify the risk and the return in

Q110: Describe source documents and their purpose.

Q118: The _ describes a company's revenues and

Q141: The accountant of Magic Video Games prepared

Q155: Cash investments by owners are listed on

Q197: Identify the three basic forms of business