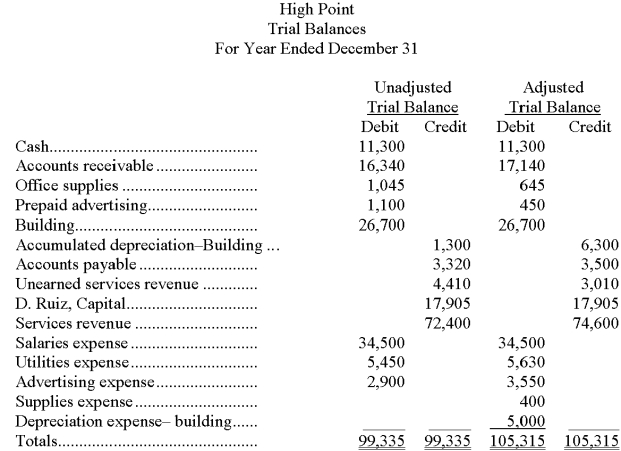

The following unadjusted and adjusted trial balances were taken from the current year's accounting system for High Point.  In general journal form, present the six adjusting entries that explain the changes in the account balances from the unadjusted to the adjusted trial balance.

In general journal form, present the six adjusting entries that explain the changes in the account balances from the unadjusted to the adjusted trial balance.

Definitions:

Straight-Line Method

A method of depreciation that allocates an equal amount of the cost of an asset over its useful life.

Depreciation Expense

The allocated amount of an asset's cost charged to expense over time, reflecting the loss in value as the asset is used in operations.

Straight-Line Depreciation Rate

A method of calculating depreciation of an asset, distributing its cost evenly across its useful life.

Useful Life

The estimated period over which a fixed asset is expected to be usable by the company, affecting its depreciation calculation.

Q23: Nick's had income of $350 million and

Q36: _ revenues are liabilities requiring delivery of

Q50: Social responsibility:<br>A) Is a concern for the

Q57: Which financial statement reports an organization's financial

Q83: FastForward purchased $25,000 of equipment for cash.

Q89: The withdrawals account is normally closed by

Q138: From the adjusted trial balance for Worker

Q152: Inventory shrinkage can be computed by comparing

Q161: A company has 20 employees who each

Q209: The accrual basis of accounting recognizes revenues