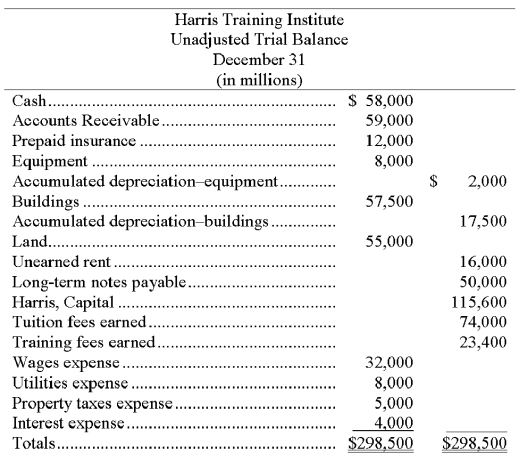

The unadjusted trial balance and the adjustment data for Harris Training Institute are given below along with adjusting entry information. What is the impact of the adjusting entries on the balance sheet? Show calculation for total assets, total liabilities, and owner's equity without the adjustments; show calculation for total assets, total liabilities, and owner's equity with the adjustments. Which one gives the most accurate presentation of the balance sheet?  Additional information items:

Additional information items:

a. The Prepaid Insurance account consists of a payment for a 1 year policy. An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.

b. A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.

c. Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

Definitions:

Chobani Greek Yogurt

A brand of Greek yogurt that is known for its rich texture, high protein content, and range of flavors, which has gained popularity in the health-food market.

Communication Process

The series of steps through which information is transmitted from one individual to another, involving encoding, medium of transmission, decoding, and feedback.

IMC Strategy

Integrated Marketing Communications Strategy, a holistic approach to promoting a brand or product that ensures all messaging and communication strategies are unified across all channels and touchpoints.

Communication

The process of transferring information, ideas, and messages from one entity to another, using various channels and mediums for effective understanding.

Q1: Withdrawals by the owner are a business

Q6: A classified balance sheet organizes assets and

Q59: Profit margin reflects the percent of profit

Q94: Permanent accounts carry their balances into the

Q105: Explain the accounting equation, and define its

Q130: Accrued revenues at the end of one

Q166: A merchandising company's _ begins with the

Q215: The assets of a company total $700,000;

Q215: If a company records prepayment of expenses

Q223: The Maxim Company acquired a building for