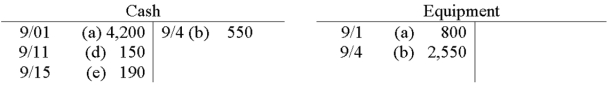

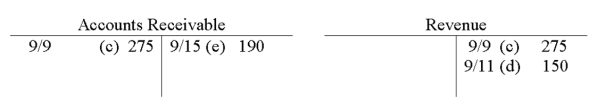

Krenz Car Care, owned and operated by Karl Krenz, began business in September of the current year. Karl, a master mechanic, had no experience with keeping a set of books. As a result, Karl entered all of September's transactions directly to the ledger accounts. When he tried to locate a particular entry he found it confusing and time consuming. He has hired you to improve his accounting procedures. The accounts in his General Ledger follow:

Prepare the general journal entries, in chronological order (a) through (e), from the T-account entries shown. Include a brief description of the probable nature of each transaction.

Prepare the general journal entries, in chronological order (a) through (e), from the T-account entries shown. Include a brief description of the probable nature of each transaction.

Definitions:

Annual Net Cash Flows

The total amount of cash that a company generates or loses over one year, after all expenses and incomes are taken into account.

Depreciated

A reduction in the value of an asset over time, often due to wear and tear or obsolescence, which is accounted for in accounting to spread the cost over its useful life.

Marginal Tax Rate

The marginal tax rate is the rate at which the last dollar of income is taxed, reflecting the rate applied to an individual's or entity's highest level of income.

Marginal Tax Rate

The rate at which the next dollar of taxable income will be taxed.

Q24: Elisabeth Kübler-Ross proposed _ sequential stages that

Q29: The debt ratio is used:<br>A) To measure

Q37: Companies experiencing seasonal variations in sales often

Q39: About _ percent of all mourners experience

Q43: Opportunities in accounting include auditing, consulting, market

Q77: The steps in the closing process are

Q94: The system of preparing financial statements based

Q159: The difference between a company's assets and

Q184: In the partnership form of business, the

Q185: Identify the types of adjusting entries and