After preparing an (unadjusted) trial balance at year-end,

G. Chu of Chu Design Company discovered the following errors:

1. Cash payment of the $225 telephone bill for December was recorded twice.

2. Cash payment of a note payable was recorded as a debit to Cash and a debit to Notes Payable for $1,000.

3. A $900 cash withdrawal by the owner was recorded to the correct accounts as $90.

4. An additional investment of $5,000 cash by the owner was recorded as a debit to

G. Chu, Capital and a credit to Cash.

5. A credit purchase of office equipment for $1,800 was recorded as a debit to the Office Equipment account with no offsetting credit entry.

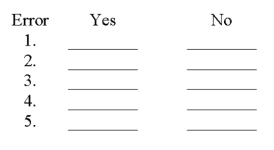

Using the form below, indicate whether the error would cause the trial balance to be out of balance by placing an X in either the yes or no column.

Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

Definitions:

Total Assets

The summation of all resources owned by a company, valued in monetary terms, including property, cash, investments, and inventory.

Solvency

A company's ability to meet its long-term debts and financial obligations.

Liquidity

The ease with which an asset can be converted into cash without affecting its market price.

Net Income

The net income of a company once all costs and taxes are subtracted from its total revenues.

Q32: Adolescents' use of the Internet to write

Q40: Failure to record depreciation expense will overstate

Q56: Intangible assets are long-term resources used to

Q67: Which of the following statements is incorrect?<br>A)

Q87: In a study of reactions to spouses'

Q103: How should adults deal with a child

Q181: Flash reported net income of $17,500 for

Q187: Explain why ethics are an integral part

Q195: Which of the following is the formula

Q239: Planning is defining an organization's ideas, goals,