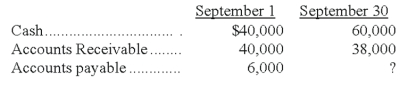

Annie's Attic has the following account balances for the dates given:  Also, its net income, for September 1 through September 30 was $20,000 and there were no investments or withdrawals by the owner. Determine the equity at both September 1 and September 30.

Also, its net income, for September 1 through September 30 was $20,000 and there were no investments or withdrawals by the owner. Determine the equity at both September 1 and September 30.

Definitions:

Marginal Federal Income Tax

The rate at which the last dollar of a taxpayer's income is taxed by the federal government.

Federal Tax Revenue

Revenue the federal government receives from taxes, including income tax, corporate tax, and other taxes.

Personal Income Tax

A tax levied by the government on individuals’ income, including wages, salaries, and investment returns.

Defense Spending

Spending by the government on military and defense activities, covering wages, machinery, research, and innovation.

Q6: Max was in critical condition when he

Q13: Thompson Company has acquired a machine from

Q31: A payment to an owner is called

Q46: According to Elisabeth Kübler-Ross, the final stage

Q67: Discuss the major differences between "child-centered" and

Q79: A preschool program that teaches basic skills

Q111: Xavier is shown two balls of Play-Doh

Q166: To focus on one aspect of a

Q199: Using the selected information given below for

Q200: The balance sheet shows a company's net