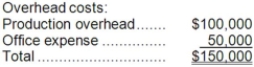

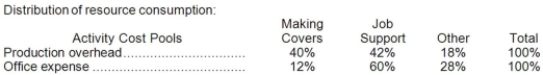

Phoenix Company makes custom covers for air conditioning units for homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The amount of activity for the year is as follows:  Required:

Required:

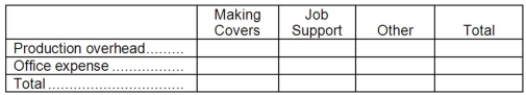

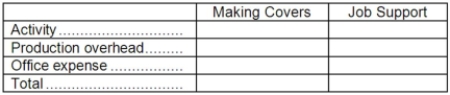

a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b. Compute the activity rates (i.e., cost per unit of activity) for the Making Awnings and Job Support activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Making Awnings and Job Support activity cost pools by filling in the table below:  c. Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1,500. The sales revenue from this job is $2,500.

c. Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1,500. The sales revenue from this job is $2,500.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

Definitions:

Q6: What is the company's overall net operating

Q22: Leading consists of guiding the efforts of

Q38: The margin of safety in dollars equals

Q54: The total gross margin for the month

Q69: Accountability in managerial performance is always accompanied

Q78: The activity rate for the Machining activity

Q79: The worldwide interdependence of resource flows, product

Q105: The contribution margin of the South business

Q133: When the number of units in work

Q148: Dace Company manufactures two products, Product F