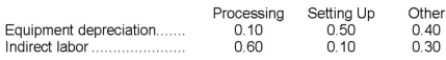

Loader Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $88,000 and indirect labor totals $1,000. Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Capital Lease

A capital lease is a lease classified by the lessee as an asset on its balance sheet, indicating that it effectively has the economic ownership of the asset, even though legally it may not own the asset.

Lease Liability

An obligation representing future lease payments a lessee is required to make under a lease agreement.

Discount Rate

The discount rate applied in calculating the present value of future cash flows during discounted cash flow analysis.

Lessor's Income Recognition

The process by which lessors report income earned from leasing out assets, typically recognized over the lease term.

Q27: How does planning fit into the four

Q35: The company's net operating income for the

Q42: The activity rate under the activity-based costing

Q47: Assume that the company uses a variable

Q56: A national retail company has segmented its

Q57: The president of Virtual Products LLC is

Q65: At First United Bank, division managers, regional

Q75: _ are specific results that one wishes

Q160: Maack Corporation's contribution margin ratio is 16%

Q225: A common fixed cost is a fixed