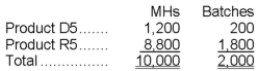

Chuang Corporation's activity-based costing system has three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:  Additional data concerning the company's products appears below:

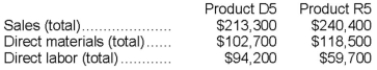

Additional data concerning the company's products appears below:  Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Federal Government

The national government of a federation, which holds authority over the entire territory, distinguishing it from state or local governments.

Ronald Reagan

The 40th President of the United States (1981–1989), known for his conservative policies, economic reforms, and role in ending the Cold War.

Market Forces

The economic factors affecting the supply and demand for goods and services in the market, including competition, consumer preferences, and regulatory policies.

Reduce Poverty

The goal or process of decreasing the number of individuals or families living below the poverty line through various economic, educational, and policy measures.

Q2: The unit product cost under super-variable costing

Q10: If a cost object such as a

Q21: _ is the process of setting goals

Q49: The net operating income for the year

Q63: In December, Mccullum Corporation sold 2,900 units

Q77: _ are developed to implement strategic plans.

Q89: The view "No one will ever know

Q99: Macmullen Corporation produces and sells two products.

Q110: The activity rate for the Machining activity

Q184: Hirz Corporation produces and sells a single