Benoist Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $17,200 for the Machining cost pool, $7,700 for the Setting Up cost pool, and $52,100 for the Other cost pool.

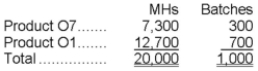

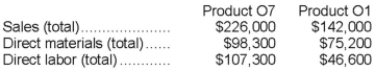

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Assets

Economic resources owned by a business or individual that are expected to bring future benefits.

Liabilities

Monetary liabilities or dues that a company or person has to pay back to lenders.

Equity

The value that would be returned to a company's shareholders if all of the assets were liquidated and all of the debts were paid off.

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity.

Q3: Suppose an action analysis report is prepared

Q10: The margin of safety as a percentage

Q35: Castle Corporation has two service departments and

Q49: George Corporation has no beginning inventory and

Q54: A plan covering the production activities of

Q61: Hettich Corporation uses an activity-based costing system

Q138: The activity rate for the Order Filling

Q158: Gaskey Inc. expects its sales in February

Q167: Propst Corporation has two divisions: Garden Division

Q215: Under absorption costing, fixed manufacturing overhead cost