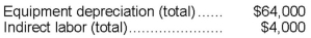

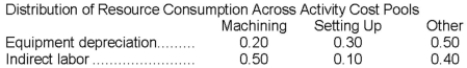

Vassallo Corporation's activity-based costing system has three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

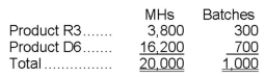

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.  Additional data concerning the company's products appears below:

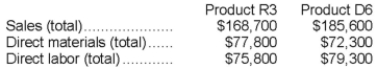

Additional data concerning the company's products appears below:  Required:

Required:

a. Assign overhead costs to activity cost pools using activity-based costing.

b. Calculate activity rates for each activity cost pool using activity-based costing.

c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d. Determine the product margins for each product using activity-based costing.

Definitions:

Watchdog Timer

Monitors logic circuits controlling the processor. If the watchdog timer, which is reset every scan, ever times out, the processor is assumed to be faulty and is disconnected from the process.

CPU

Central Processing Unit, the primary component of a computer that performs most of the processing inside a computer.

Output Module

A component in a control system that sends signals or power from the system to the external environment.

PLC System

A PLC system (Programmable Logic Controller) is a digital computer used for automation of electromechanical processes, such as control of machinery on factory assembly lines.

Q15: The process of predicting what will happen

Q19: Liest Corporation produces and sells a single

Q19: What is the most critical factor for

Q30: Wahler Corporation manufactures and sells one product.

Q41: Dubey Surgical Hospital uses the direct method

Q69: In traditional costing systems, manufacturing costs that

Q80: _ measures profit generation.

Q85: A company that produces a single product

Q100: The company's contribution margin ratio is closest

Q224: Sproull Inc., which produces a single product,