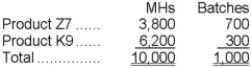

Deraney Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $5,800 for the Machining cost pool, $4,700 for the Setting Up cost pool, and $7,500 for the Other cost pool. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products appear below:  Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Definitions:

State

A political entity with a centralized government that has sovereignty over a geographic area.

Partnership

An association of two or more persons to carry on as co-owners of a business for profit.

Partner

In a business context, an individual or another business entity that shares ownership of a company and is involved in its strategic decision-making processes.

Patents

Legal rights granted to inventors, providing exclusive use and control over their new inventions for a specific period.

Q17: Managers will often allocate common fixed expenses

Q19: What is the most critical factor for

Q43: As a manager of a firm, what

Q71: At each stage of decision making, spotlight

Q80: The fourth step in the decision-making process

Q81: A(n) _ clarifies the purpose of an

Q139: The company's overall break-even sales is closest

Q154: DC Construction has two divisions: Remodeling and

Q178: What was the absorption costing net operating

Q213: The term gross margin is used in