Flyer Corporation manufactures two products, Product A and Product

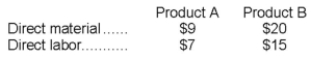

A.Product B is produced on an automated production line.Overhead is currently assigned to the products on the basis of direct-labor-hours.The company estimated it would incur $396,000 in manufacturing overhead costs and produce 5,500 units of Product B and 22,000 units of Product A during the current year.Unit costs for materials and direct labor are:

Required:

Required:

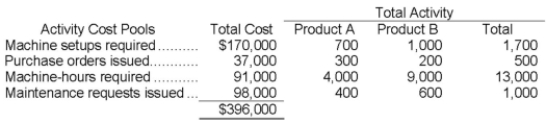

a.Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.b.The company's overhead costs can be attributed to four major activities.These activities and the amount of overhead cost attributable to each for the current year are given below:

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

A.Product B is the more complex of the two products, requiring three hours of direct labor time per unit to manufacture compared to one and one-half hours of direct labor time for Product

B.Product B is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product

Definitions:

Q3: The company's unit contribution margin is closest

Q22: Which of the following levels of costs

Q33: Gough Corporation has two divisions: Domestic and

Q47: Assume that the company uses a variable

Q56: Which of the following statements is true

Q73: What is the unit product cost for

Q75: What is the margin of safety in

Q115: All other things the same, in periods

Q117: What is the net operating income for

Q149: What is the overhead cost assigned to