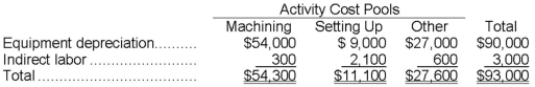

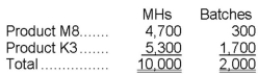

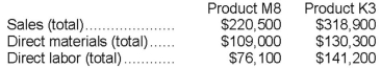

Somani Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below.  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Payroll Taxes

Taxes that are withheld from employees' wages or paid by employers on behalf of their employees, typically including social security and medicare taxes.

Subcontractors

Individuals or companies hired by a primary contractor to perform specific tasks as part of a larger project.

Vendors

Businesses or individuals that supply goods or services to another business.

Timesheet

A timesheet is a document or tool used to track the amount of time an employee has worked on various tasks or projects.

Q2: If a cost object such as a

Q8: _ limitations make it hard for managers

Q11: The direct method is used by Adamski

Q19: Through networking, managers build and maintain positive

Q42: Identifying and taking action to resolve problems

Q48: On a cost-volume-profit graph, the revenue line

Q102: The plant manager's salary is an example

Q151: The selling price of Roscioli Corporation's only

Q152: Errera Corporation has two major business segments-Retail

Q206: Under variable costing, what is the total