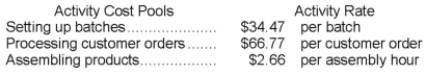

Villeda Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.  Data concerning two products appear below:

Data concerning two products appear below:  Required:

Required:

How much overhead cost would be assigned to each of the two products using the company's activity-based costing system?

Definitions:

Hormone

A chemical secreted by a cell that affects the functions of other cells.

Steroidal Hormones

Hormones derived from cholesterol, including sex hormones and corticosteroids, which play vital roles in body functions.

Genes

Units of heredity made up of DNA that encode the information necessary to build and maintain an organism's cells and pass traits to offspring.

Nucleus

The central and most important part of an object, movement, or group, forming the basis for its activity and growth; in cells, it is the organelle that houses the cell's DNA.

Q7: The cost per unit of Product B

Q31: _ managers oversee the work of large

Q39: All differences between super-variable costing and absorption

Q72: The Agate Corporation manufactures and sells two

Q76: The final step in the decision-making process

Q105: Data concerning Wythe Corporation's single product appear

Q124: Assuming that all of the costs listed

Q139: The Thornes Cleaning Brigade Company provides housecleaning

Q186: Carrejo Corporation has two divisions: Division M

Q236: Under variable costing, net operating income would