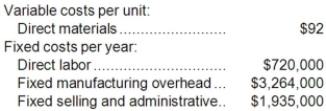

Calder Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 48,000 units and sold 45,000 units. The company's only product is sold for $258 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 48,000 units and sold 45,000 units. The company's only product is sold for $258 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year.

b. Assume the company uses super-variable costing. Prepare an income statement for the year.

Definitions:

Identified Purposes

Specific reasons or objectives for which something is done or for which data is collected, often outlined to ensure clarity and compliance.

International Anti-Bribery

International Anti-Bribery pertains to global efforts and regulations aimed at preventing, detecting, and penalizing corrupt practices and bribery in international business transactions.

Foreign Corrupt Practices Act

A U.S. law aimed at preventing companies from bribing foreign officials to obtain or retain business.

Cross-Border Insolvencies

Legal proceedings dealing with the insolvency of debtors who have assets or creditors in more than one country.

Q5: Which of the following concepts suggests that

Q6: Tom is responsible for a group of

Q7: Different people have different views of what

Q25: Under absorption costing, what is the total

Q61: Hettich Corporation uses an activity-based costing system

Q71: The levels of work and responsibility remain

Q76: Reynold Enterprises sells a single product for

Q143: Garcia Veterinary Clinic expects the following operating

Q175: Assume a company sells a single product.

Q217: When production exceeds sales and the company