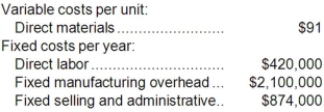

Griffy Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 30,000 units and sold 23,000 units. The company's only product is sold for $239 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 30,000 units and sold 23,000 units. The company's only product is sold for $239 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.

b. Assume that the company uses an absorption costing system that assigns $14 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.

c. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Definitions:

Different Perspectives

Diverse viewpoints or angles from which to approach an issue or assess a situation, originating from unique individual experiences or backgrounds.

Advance Directive

Legal documents that allow individuals to outline their preferences for medical care if they are unable to make decisions for themselves in the future.

Ethical Committee

A group tasked with reviewing and providing guidance on ethical issues in a particular context, such as medical research or corporate decision-making.

Extraordinary Resuscitation

An intensive medical rescue effort to revive someone from a state of apparent death or unconsciousness.

Q29: Alpha Corporation reported the following data for

Q35: The company's net operating income for the

Q43: If you are going on an international

Q65: Article 19 of the Universal Declaration of

Q104: Grable Corporation produces and sells a single

Q107: The margin of safety as a percentage

Q133: Product-level activities relate to how many batches

Q173: The management of Pacubas Corporation expects sales

Q177: What is the company's overall net operating

Q212: Swifton Corporation produces a single product. Last