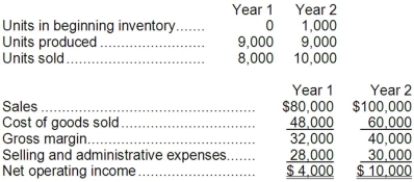

Hanks Corporation produces a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:  Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead was $18,000 in each year. This fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.

Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead was $18,000 in each year. This fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.

Required:

a. Compute the unit product cost in each year under variable costing.

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Communication Role

The function or part played by communication in various contexts, such as facilitating information exchange, resolving conflicts, or social interaction.

Intrapersonal Communication

The process of internal dialogue or communication within oneself, involving thoughts and emotions.

Therapeutic Communication Techniques

Methods used by healthcare professionals to support their clients emotionally and psychologically, enhancing understanding and healing.

Suspected Appendicitis

A condition where there’s a suspicion of inflammation or infection of the appendix, potentially requiring medical evaluation or surgery.

Q23: If the company bases its predetermined overhead

Q44: The company is considering using either super-variable

Q56: The "costs to be accounted for" portion

Q59: Toefield Corporation uses the FIFO method in

Q90: Assembling a product is an example of

Q102: What are the equivalent units for conversion

Q107: The cost per equivalent unit for conversion

Q107: Under variable costing the value of the

Q114: Under variable costing, product cost does not

Q171: Rede Inc. manufactures a single product. Variable