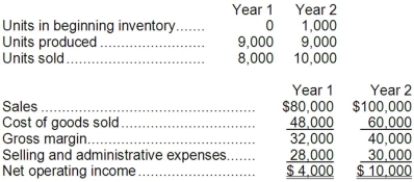

Hanks Corporation produces a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:  Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead was $18,000 in each year. This fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.

Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead was $18,000 in each year. This fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.

Required:

a. Compute the unit product cost in each year under variable costing.

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Typical

Characteristic of a particular group, class, or category, often used to describe what is considered normal or expected.

Saltation

Transport of sediment in which particles are moved in a series of short, intermittent bounces on a bottom surface.

Streambed

The bottom surface of a stream or river channel where water flows, often consisting of sediment, rocks, and organic material.

Stream Transportation

The process by which streams and rivers carry sediment and other materials from one place to another.

Q4: In the first step of the allocation,

Q10: How much overhead cost is allocated to

Q19: Assume that the company uses a variable

Q26: Pratt Corporation has two major business segments-Apparel

Q59: In traditional costing, some manufacturing costs may

Q62: Data concerning Ulwelling Corporation's single product appear

Q84: Zhang Corporation uses process costing. A number

Q157: Under variable costing, the unit product cost

Q159: What was the absorption costing net operating

Q227: What is the net operating income for