Cabat Company manufactures two products, Product C and Product D. The company estimated it would incur $177,910 in manufacturing overhead costs during the current period. Overhead currently is applied to the products on the basis of direct labor-hours. Data concerning the current period's operations appear below:

Required:

Required:

a. Compute the predetermined overhead rate under the current method, and determine the unit product cost of each product for the current year.

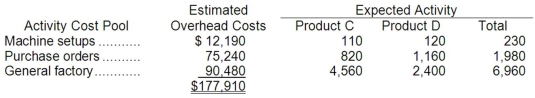

b. The company is considering using an activity-based costing system to compute unit product costs for external financial reports instead of its traditional system based on direct labor-hours. The activity-based costing system would use three activity cost pools. Data relating to these activities for the current period are given below:

Determine the unit product cost of each product for the current period using the activity-based costing approach. General factory overhead is allocated based on direct labor-hours.

Determine the unit product cost of each product for the current period using the activity-based costing approach. General factory overhead is allocated based on direct labor-hours.

Definitions:

Nation-States

Political entities consisting of a clearly defined territory and a government that has sovereignty over its internal and foreign affairs.

Disjunctures

Points of disruption or disconnection within societal systems or between personal expectations and reality.

Technoscapes

Refers to the global landscape of technology, emphasizing how technological flows across borders shape cultures and interactions.

Arjun Appadurai

An influential contemporary anthropologist known for his work on globalization, focusing on the cultural dynamics of technology, finance, and social theory.

Q1: The unit product cost of product U86Y

Q16: Using the high-low method, the estimate of

Q52: Cribb Corporation uses direct labor-hours in its

Q53: Hoop Corporation has four different products

Q55: Vercher Natal Clinic uses the step-down method

Q79: Parker Company uses a job-order costing system

Q82: Koelsch Corporation's only product sells for $170

Q105: Data concerning Wythe Corporation's single product appear

Q157: The gross margin for July is:<br>A)$1,618,100<br>B)$699,300<br>C)$359,900<br>D)$534,600

Q167: Direct labor is a part of prime