The Commonwealth Company uses a job-order costing system and applies manufacturing overhead cost to jobs using a predetermined overhead rate based on the cost of materials used in production. At the beginning of the year, the following estimates were made as a basis for computing the predetermined overhead rate: manufacturing overhead cost, $186,000; direct materials cost, $155,000. The following transactions took place during the year (all purchases and services were acquired on account):

a. Raw materials purchased, $96,000.

b. Raw materials requisitioned for use in production (all direct materials), $88,000.

c. Utility bills incurred in the factory, $17,000.

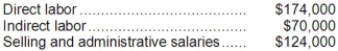

d. Costs for salaries and wages incurred as follows:  e. Maintenance costs incurred in the factory, $12,000.

e. Maintenance costs incurred in the factory, $12,000.

f. Advertising costs incurred, $98,000.

g. Depreciation recorded for the year, $75,000 (75 percent relates to factory assets and the remainder relates to selling, general, and administrative assets).

h. Rental cost incurred on buildings, $80,000 (80 percent of the space is occupied by the factory, and 20 percent is occupied by sales and administration).

i. Miscellaneous selling, general, and administrative costs incurred, $12,000.

j. Manufacturing overhead cost was applied to jobs.

k. Cost of goods manufactured for the year, $480,000.

l. Sales for the year (all on account) totaled $900,000. These goods cost $550,000 to manufacture.

Required:

Prepare journal entries to record the information above. Key your entries by the letters a through l.

Definitions:

Cost of Capital

The rate of return a company must pay to its shareholders and debt holders, representing the cost of obtaining funds to finance its operations.

Long-Term Funds

Investments or sources of financing that are provided or required for a duration exceeding one year.

Acquisition of Assets

The process by which a company purchases or obtains assets, such as property, equipment, or other resources, to enhance its business operations.

Target Capital Structure

The mix of debt, equity, and other financing methods a company aims to use to fund its operations and growth.

Q1: How many units of product B27D should

Q11: When analyzing a mixed cost, you should

Q26: Liquidity refers to how quickly an asset

Q37: Assume that after introducing the new product,

Q51: Assuming that the company uses the FIFO

Q51: Vota Clinic uses the direct method to

Q76: The price-earnings ratio is determined by dividing

Q126: Valley Manufacturing Corporation's beginning work in process

Q132: What journal entry is made in a

Q158: If a retailer sells a product whose