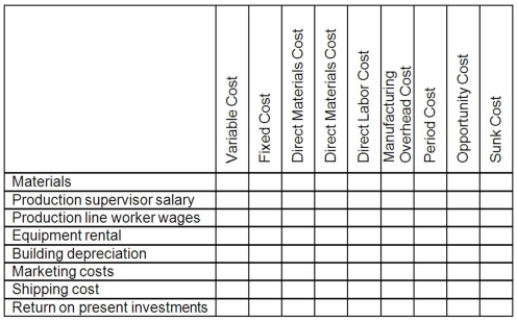

The Plastechnics Company began operations several years ago. The company's product requires materials that cost $25 per unit. The company employs a production supervisor whose salary is $2,000 per month. Production line workers are paid $15 per hour to manufacture and assemble the product. The company rents the equipment needed to produce the product at a rental cost of $1,500 per month. The building is depreciated on the straight-line basis at $9,000 per year.

The company spends $40,000 per year to market the product. Shipping costs for each unit are $20 per unit.

The company plans to liquidate several investments in order to expand production. These investments currently earn a return of $8,000 per year.

Required:

Complete the answer sheet below by placing an "X" under each heading that identifies the cost involved. The "Xs" can be placed under more than one heading for a single cost, e.g., a cost might be a sunk cost, an overhead cost, and a product cost.

Definitions:

SBUs

Organizational units within larger corporations, each responsible for its own market segment and bottom-line objectives, functioning with their strategies and objectives.

Question Marks

Products in a business portfolio that have high growth potential but low market share, often requiring significant investment to grow.

Stars

In the context of the Boston Consulting Group (BCG) matrix, products or business units that have a high market share in a fast-growing industry and are considered to be potential market leaders.

High-Growth Markets

Markets characterized by significantly higher than average growth rates, often driven by new technologies or changing consumer behaviors.

Q11: Reven Corporation prepares its statement of cash

Q28: Thread that is used in the production

Q53: Using the high-low method, the estimate of

Q61: How many units are in ending work

Q74: The opportunity cost of using a unit

Q83: The formula for computing the predetermined overhead

Q102: Discretionary fixed costs:<br>A)have a planning horizon that

Q130: The dividend payout ratio is equal to

Q186: The company's book value per share at

Q190: The company's inventory turnover for Year 2