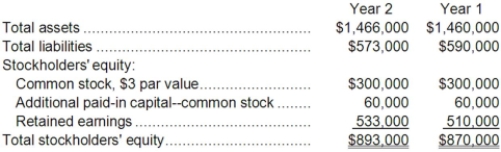

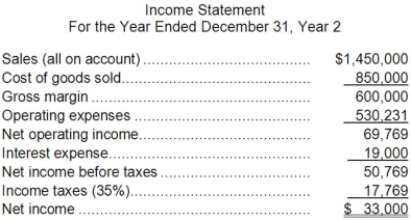

Jaquez Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $10,000. The market price of common stock at the end of Year 2 was $5.45 per share.

Dividends on common stock during Year 2 totaled $10,000. The market price of common stock at the end of Year 2 was $5.45 per share.

Required:

a. What is the company's times interest earned for Year 2?

b. What is the company's debt-to-equity ratio at the end of Year 2?

c. What is the company's equity multiplier at the end of Year 2?

d. What is the company's net profit margin percentage for Year 2?

e. What is the company's gross margin percentage for Year 2?

f. What is the company's return on total assets for Year 2?

g. What is the company's return on equity for Year 2?

h. What is the company's earnings per share for Year 2?

i. What is the company's price-earnings ratio for Year 2?

j. What is the company's dividend payout ratio for Year 2?

k. What is the company's dividend yield ratio for Year 2?

l. What is the company's book value per share at the end of Year 2?

Definitions:

Immediate Reinforcement

The prompt delivery of a reward or consequence following a behavior, which increases the likelihood of that behavior being repeated.

Modeling

Modeling refers to the process of representing, simulating, or teaching behavior, skills, or processes by example.

Respondent Behavior

Behavior that occurs as a direct response to a specific stimulus without conscious thought.

Spontaneous Recovery

In psychology, the reappearance of a conditioned response after a delay or period of extinction.

Q8: The payback period for the investment is

Q14: From the standpoint of the entire company,

Q14: Preference decisions follow screening decisions and seek

Q32: Dorich Corporation would like to determine

Q44: The company's average sale period (turnover in

Q48: Redshaw Corporation has provided the following

Q64: The constraint at Mirsch Inc. is

Q90: The total cash flow net of income

Q107: If 24,000 units are sold during the

Q141: Smay Corporation has provided the following