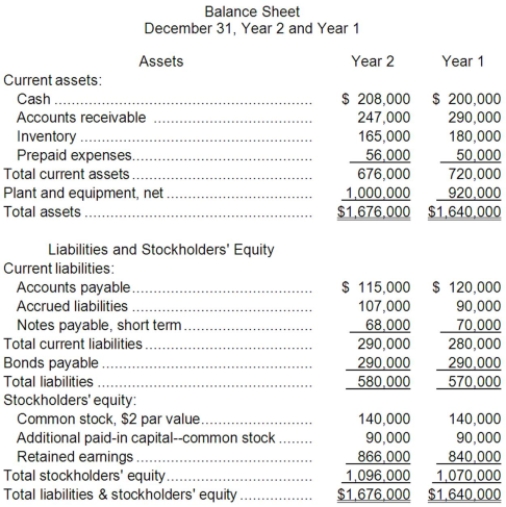

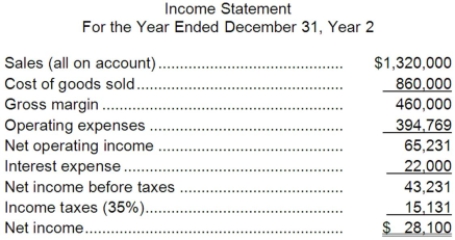

Straton Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $2,100. The market price of common stock at the end of Year 2 was $5.56 per share.

Dividends on common stock during Year 2 totaled $2,100. The market price of common stock at the end of Year 2 was $5.56 per share.

Required:

a. What is the company's net profit margin percentage for Year 2?

b. What is the company's gross margin percentage for Year 2?

c. What is the company's return on total assets for Year 2?

d. What is the company's return on equity for Year 2?

e. What is the company's earnings per share for Year 2?

f. What is the company's price-earnings ratio for Year 2?

g. What is the company's dividend payout ratio for Year 2?

h. What is the company's dividend yield ratio for Year 2?

i. What is the company's book value per share at the end of Year 2?

Definitions:

Reactive Aggression

A form of aggressive behavior that is prompted in response to a perceived threat or frustration, often impulsive and emotional rather than premeditated.

Overt Aggression

A form of aggressive behavior that is openly displayed and directly targeted towards someone, often involving physical or verbal hostility.

Passive Aggression

A behavior pattern where negative feelings are expressed indirectly rather than directly, often through procrastination, stubbornness, and sullenness.

Assertive

The quality of being confidently self-assured, expressing one's needs and opinions in a respectful and direct manner.

Q28: The combined present value of the working

Q45: The total cash flow net of income

Q59: What is the maximum contribution margin the

Q60: An investment project with a project profitability

Q65: Negative free cash flow suggests that the

Q91: The company's return on total assets for

Q96: The company's current ratio is closest to:<br>A)0.26<br>B)2.65<br>C)0.50<br>D)0.53

Q107: The current ratio at the end of

Q118: Paying taxes to governmental bodies is considered

Q119: The net present value of the proposed