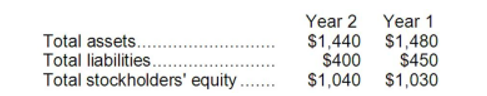

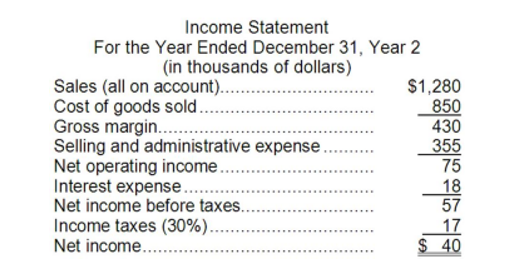

Data from Lheureux Corporation's most recent balance sheet and the company's income statement appear below:

-The times interest earned for Year 2 is closest to:

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, influencing decisions about whether to engage in activities that will produce additional income.

Tax Liability

The total amount of tax that an individual or entity is legally obligated to pay to a tax authority.

Social Security Tax

A tax levied on both employers and employees to fund the Social Security program, typically taken as a percentage of wages.

Taxable Income

The amount of an individual's or a corporation's income that is subject to taxes, after all deductions and exemptions.

Q20: Reetz Corporation would like to determine

Q44: On the statement of cash flows, the

Q53: The project profitability index is used to

Q76: What is Stone's net cash provided (used)

Q99: The following events occurred last year for

Q157: Grosvenor Corporation's most recent income statement appears

Q171: The company's inventory turnover for Year 2

Q204: The company's earnings per share for Year

Q255: Dratif Corporation's working capital is $33,000 and

Q272: The company's net profit margin percentage for