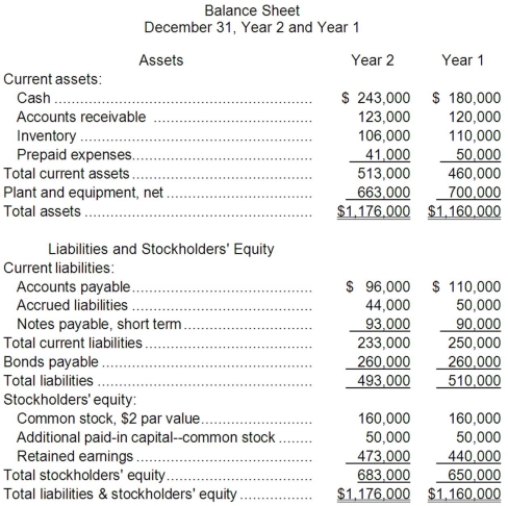

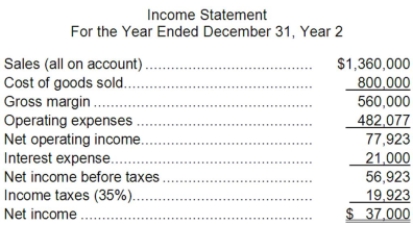

Kisselburg Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $4,000. The market price of common stock at the end of Year 2 was $5.75 per share.

Dividends on common stock during Year 2 totaled $4,000. The market price of common stock at the end of Year 2 was $5.75 per share.

Required:

a. What is the company's working capital at the end of Year 2?

b. What is the company's current ratio at the end of Year 2?

c. What is the company's acid-test (quick) ratio at the end of Year 2?

d. What is the company's accounts receivable turnover for Year 2?

e. What is the company's average collection period (age of receivables) for Year 2?

f. What is the company's inventory turnover for Year 2?

g. What is the company's average sale period (turnover in days) for Year 2?

h. What is the company's operating cycle for Year 2?

i. What is the company's total asset turnover for Year 2?

j. What is the company's times interest earned for Year 2?

k. What is the company's debt-to-equity ratio at the end of Year 2?

l. What is the company's equity multiplier at the end of Year 2?

m. What is the company's net profit margin percentage for Year 2?

n. What is the company's gross margin percentage for Year 2?

o. What is the company's return on total assets for Year 2?

p. What is the company's return on equity for Year 2?

q. What is the company's earnings per share for Year 2?

r. What is the company's price-earnings ratio for Year 2?

s. What is the company's dividend payout ratio for Year 2?

t. What is the company's dividend yield ratio for Year 2?

u. What is the company's book value per share at the end of Year 2?

Definitions:

Average Annual

Average annual typically refers to the mean amount or figure calculated over a year's period, often used in financial, operational, or performance metrics.

Average Amount

The average amount refers to the arithmetic mean of a set of numbers or quantities, obtained by summing them together and then dividing by the count of these numbers.

Amortization Period

The duration of time over which the cost of an intangible asset is incrementally expensed or amortized to a company's financial statements.

Net Cash Inflows

The total amount of money received minus the total amount of money spent over a specific period of time.

Q23: The accounts receivable turnover for Year 2

Q32: Under the indirect method of determining the

Q51: The product's price elasticity of demand as

Q62: What is the maximum contribution margin the

Q71: Up to how much should the company

Q82: The company's operating cycle for Year 2

Q98: The net present value of this investment

Q113: Rawdon Corporation's net operating income in Year

Q127: Uhri Corporation has provided the following data:

Q228: The company's net profit margin percentage for