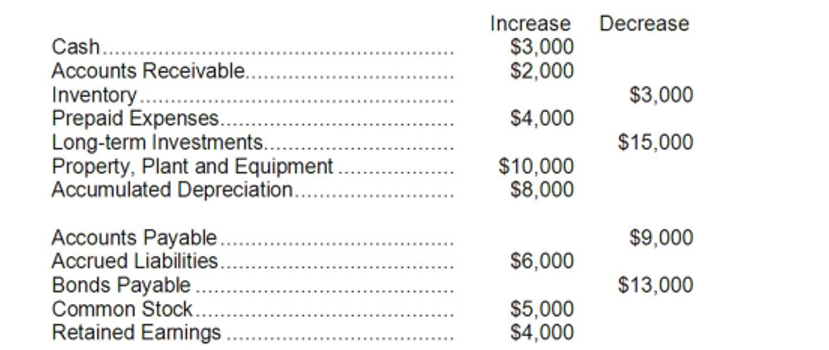

The change in each of Kendall Corporation's balance sheet accounts last year follows:

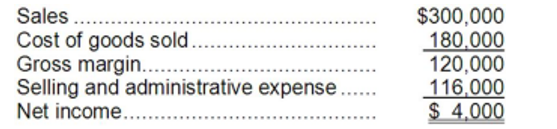

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-The net cash provided (used) by financing activities would be:

Definitions:

S&P 500 Index

An American stock market index based on the market capitalizations of 500 large companies listed on stock exchanges in the United States.

Operating Leverage

A measure of how sensitive a company's operating income is to a change in revenues, highlighting the impact of fixed versus variable costs.

Profits

The financial gain achieved when the revenue generated from a business activity exceeds the expenses, costs, and taxes needed to sustain the activity.

GDP

Gross Domestic Product, the total monetary or market value of all the finished goods and services produced within a country's borders in a specific time period, acting as a broad indicator of economic activity.

Q20: Under the direct method of determining the

Q22: The company's operating cycle for Year 2

Q50: The absolute profitability of a segment is

Q51: The product's price elasticity of demand as

Q56: Simmons Corporation estimated that the following

Q57: (Ignore income taxes in this problem.) The

Q62: Desalvo Corporation is introducing a new product

Q74: A common-size financial statement is a vertical

Q132: The best capital budgeting method for ranking

Q233: The company's total asset turnover for Year