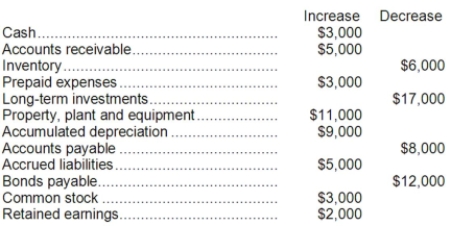

The changes in each balance sheet account for Carver Corporation during the year just completed are as follows:  Carver Corporation's income statement for the year just ended shows the following:

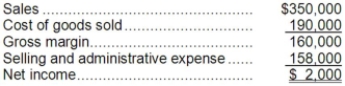

Carver Corporation's income statement for the year just ended shows the following:  The company did not dispose of any property, plant, and equipment, buy any long-term investments, issue any bonds payable, or repurchase any of its own common stock during the year. Carver Corporation uses the direct method to construct its statement of cash flows.

The company did not dispose of any property, plant, and equipment, buy any long-term investments, issue any bonds payable, or repurchase any of its own common stock during the year. Carver Corporation uses the direct method to construct its statement of cash flows.

Required:

a. Determine the sales adjusted to the cash basis.

b. Determine the cost of goods sold adjusted to the cash basis.

c. Determine the selling and administrative expenses adjusted to a cash basis.

d. Determine the net cash provided (used) by operating activities.

e. Determine the net cash provided (used) by investing activities.

f. Determine the net cash provided (used) by financing activities.

Definitions:

WACC

Weighted Average Cost of Capital; it represents a firm's blended cost of capital across all sources, including both debt and equity.

MCC Schedule

Marginal cost of capital schedule. A plot of the WACC (weighted average cost of capital) against the total amount of capital to be raised in a planning period. The MCC rises as more capital is raised and the costs of individual components experience step function increases.

Capital Spending

Refers to funds spent by a business or government on acquiring or maintaining physical assets such as property, plants, and equipment.

MCC

Marginal Cost of Capital; the cost of obtaining an additional dollar of new capital.

Q8: The company's working capital at the end

Q9: A cost that is relevant in one

Q26: Stortz Corporation is considering a capital budgeting

Q43: The most recent balance sheet and income

Q59: Leamon Corporation is considering a capital budgeting

Q68: Revello Corporation is considering a capital budgeting

Q103: The investment required for the project profitability

Q166: (Ignore income taxes in this problem) The

Q208: Purchasing marketable securities with cash will have

Q224: The times interest earned ratio of Whitney