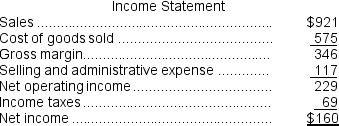

(Appendix 14A) The most recent balance sheet and income statement of Oldaker Corporation appear below:

The company paid a cash dividend of $42 and it did not dispose of any property, plant, and equipment. The company did not retire any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend of $42 and it did not dispose of any property, plant, and equipment. The company did not retire any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in) operating activities for the year was:

Definitions:

Compounded Annually

Interest calculation method where interest is added to the principal sum at the end of each year, and the subsequent interest calculation includes the previously accumulated interest.

Simple Interest

Interest calculated on the principal portion of a loan or deposit, without compounding.

Interest

Payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum, at a particular rate.

Housing Prices

The amount of money required to purchase residential properties, which fluctuates based on location, demand, and other factors.

Q24: The net present value of project Y

Q27: Laverde Corporation has provided the following

Q57: Furis Corporation's cash and cash equivalents consist

Q106: The income tax expense in year 3

Q126: Cash payments to repay the principal amount

Q136: The profitability index of investment project C

Q160: If the project profitability index of an

Q175: Orem Corporation's current liabilities are $75,000, its

Q246: Cameron Corporation had 50,000 shares of

Q283: When fixed costs are included in the