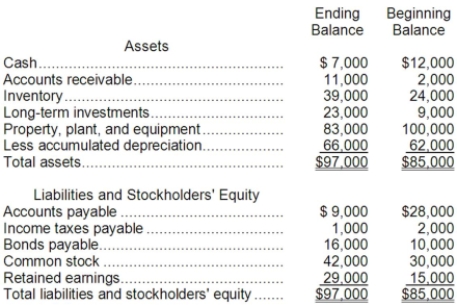

Alden Corporation's most recent comparative Balance Sheet is as follows:  Alden's net income was $34,000. No equipment was purchased and no long-term investments were sold. There was a gain of $3,000 when equipment was sold. The accumulated depreciation on the equipment that was sold was $12,000. Cash dividends of $20,000 were declared and paid during the year.

Alden's net income was $34,000. No equipment was purchased and no long-term investments were sold. There was a gain of $3,000 when equipment was sold. The accumulated depreciation on the equipment that was sold was $12,000. Cash dividends of $20,000 were declared and paid during the year.

Required:

Prepare Alden's statement of cash flows using the indirect method.

Definitions:

Workforce Competencies

The range of skills, knowledge, and abilities required for employees to perform tasks and roles effectively within an organization.

High-Performance Work System (HPWS)

An organizational approach combining employee involvement, technology, and managerial practices to enhance performance and competitiveness.

Organizational Citizenship Behavior

Voluntary actions performed by employees that are not part of their formal job requirements but contribute to the overall effectiveness of the organization.

Volunteered

The act of offering services or providing help without compensation or expectation of personal gain.

Q22: Under the direct method, sales adjusted to

Q37: Fraction Corporation has provided the following financial

Q51: Evita Corporation prepares its statement of cash

Q51: In a decision to drop a segment,

Q63: The company's working capital is:<br>A)$1,215,000<br>B)$542,000<br>C)$793,000<br>D)$709,000

Q79: Diss Corporation is considering a capital budgeting

Q109: (Ignore income taxes in this problem.) Betterway

Q158: One of the advantages of allocating common

Q182: Part A42 is used by Elgin Corporation

Q251: For Year 2, Etzkorn Corporation's sales were