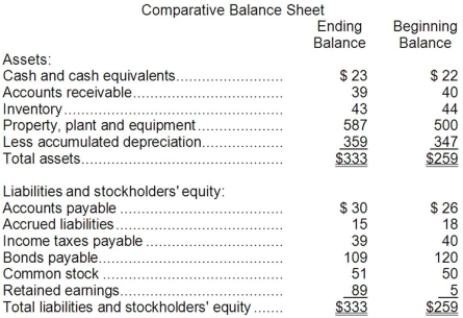

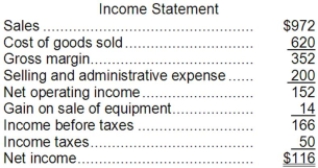

Mattix Corporation's balance sheet and income statement appear below:

The company sold equipment for $20 that was originally purchased for $7 and that had accumulated depreciation of $1. It paid a cash dividend during the year and did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $20 that was originally purchased for $7 and that had accumulated depreciation of $1. It paid a cash dividend during the year and did not issue any bonds payable or repurchase any of its own common stock.

Required:

Determine the net cash provided by (used in) operating activities for the year using the indirect method.

Definitions:

Insurance Policy

A contract between an insurer and a policyholder stipulating the terms under which the insurer agrees to compensate the insured for specific losses.

Adjusting Entry

An accounting entry made into a journal at the end of an accounting period to allocate income and expenditure to the period in which they actually occurred.

Property Tax

A tax assessed on real estate by the local government and based on the property's value.

Adjusting Journal Entry

A journal record used to adjust the balances in various ledger accounts to more accurately reflect income and expenses for the period.

Q4: Kuma, Inc. had cost of goods sold

Q11: The present value of an amount to

Q52: (Ignore income taxes in this problem.) Burba

Q57: (Ignore income taxes in this problem.) The

Q101: The net present value of the entire

Q107: The current ratio at the end of

Q117: The management of Bercegeay Corporation is considering

Q145: Shaddock Corporation is considering a capital budgeting

Q152: The company's accounts receivable turnover for Year

Q157: Grosvenor Corporation's most recent income statement appears