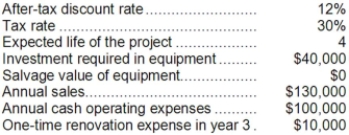

Bourret Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

Definitions:

Sale Of Investments

The process of selling investment assets such as stocks, bonds, or real estate, typically to generate cash or realize gains.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, representing the asset's consumption or the loss of its value over time.

Net Income

The total earnings of a company after subtracting all expenses from revenue, including taxes and operating costs, often referred to as the bottom line.

Indirect Method

The indirect method is a widely used approach for preparing the cash flow statement, where net income is adjusted for changes in balance sheet accounts to calculate cash flow from operating activities.

Q22: A disadvantage of vertical integration is that

Q65: The income tax expense in year 3

Q67: Adah Corporation prepares its statement of cash

Q68: Pashicke Corporation recently changed the selling

Q108: (Ignore income taxes in this problem.) Riveros,

Q110: The income tax expense in year 3

Q124: The company's net cash provided by operating

Q144: (Ignore income taxes in this problem.) Boyson,

Q179: The debt-to-equity ratio at the end of

Q279: The company's price-earnings ratio is closest to:<br>A)19.79<br>B)0.51<br>C)8.36<br>D)12.53