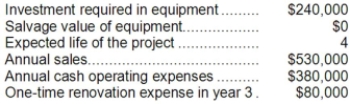

Bosell Corporation has provided the following information concerning a capital budgeting project:  The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

Definitions:

Thomas Jefferson

The principal writer of the Declaration of Independence and a founding father who also served as the third President of the United States.

Declaration Of Independence

Document adopted on July 4, 1776, that made the break with Britain official; drafted by a committee of the Second Continental Congress, including principal writer Thomas Jefferson.

Bill For Establishing Religious Freedom

A Virginia law, drafted by Thomas Jefferson in 1777 and enacted in 1786, that guarantees freedom of, and from, religion.

Apprenticeship And Indentured Servitude

A system where a person learns a trade from a skilled employer, historically often without pay but in exchange for food, accommodation, and training.

Q36: Last year Lawn Corporation reported sales of

Q41: In a statement of cash flows, issuing

Q69: In capital budgeting computations, discounted cash flow

Q78: The accounts receivable for Note Corporation was

Q98: Vogelsberg Corporation has provided the following financial

Q132: The best capital budgeting method for ranking

Q140: Discounted cash flow techniques do not take

Q167: Depreciation expense on existing factory equipment is

Q185: Moselle Corporation has provided the following financial

Q273: Sehrt Corporation has provided the following financial