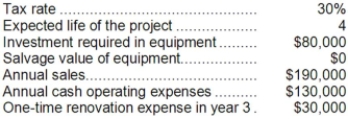

Wollard Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

Definitions:

Flowering Plants

Plants that produce flowers as reproductive structures, capable of developing into fruit and seeds.

Biomarker

Molecular evidence of life in the fossil record. Biomarkers can include fragments of DNA, molecules such as amino acids, or isotopic ratios.

Amino Acids

Organic compounds that combine to form proteins, serving as the building blocks of life and playing a central role in biological processes.

Carbon-13:Carbon-12

This ratio is used in scientific studies to understand various processes such as photosynthesis and to trace the path of carbon through ecosystems due to the distinct signatures of carbon-13 and carbon-12.

Q25: On the statement of cash flows, the

Q32: The debt-to-equity ratio at the end of

Q34: The total cash flow net of income

Q51: Evita Corporation prepares its statement of cash

Q90: Assume that dropping Product G would result

Q106: Which of the following would be classified

Q110: Under the indirect method of determining the

Q118: Paying taxes to governmental bodies is considered

Q141: The total cash flow net of income

Q169: (Ignore income taxes in this problem.) The