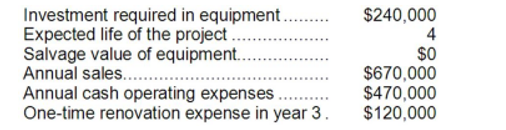

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

Definitions:

Shareholders

Individuals or entities that own share(s) of stock in a corporation, thus holding a portion of the ownership and rights to profits.

Disadvantages

are the unfavorable or negative aspects of a situation, plan, or condition that may cause difficulties or reduce chances of success.

Life Cycle

The series of changes in the life of an organism, including birth, growth, reproduction, and death; it can also refer to similar stages in the development of products or organizations.

Entrepreneurial Firms

Businesses that seek to innovate in terms of product, service, market, or business model, typically characterized by risk-taking and proactive initiatives.

Q3: Babbitt Corporation has provided the following data

Q4: Ignoring the cash inflows, to the nearest

Q9: Computing the present value of future dollars

Q39: Gremel Corporation has provided the following financial

Q54: The changes in each balance sheet account

Q72: (Ignore income taxes in this problem.) Veys

Q83: Which one of the following transactions should

Q108: In the statement of cash flows, collecting

Q125: Deflorio Corporation's inventory at the end of

Q190: The company's inventory turnover for Year 2