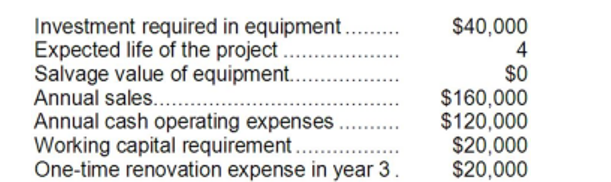

Shinabery Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Type A

A personality type characterized by competitiveness, impatience, and a high level of stress.

Type B

A personality type characterized by a more relaxed, less competitive, and less stress-prone behavior pattern compared to Type A.

Heart Disease

A broad term for a variety of diseases affecting the heart and blood vessels, such as coronary artery disease, heart failure, and arrhythmias.

Positivity

The practice or tendency of being optimistic in attitude and focusing on the good aspects of any situation.

Q15: Insurance and utility expenses are considered operating

Q23: The net cash provided by (used in)

Q33: Hauge Corporation is considering a capital budgeting

Q45: The total cash flow net of income

Q52: The company's average collection period (age of

Q106: The company's average sale period (turnover in

Q116: Holzner Corporation has provided the following information

Q125: Hal currently works as the fry guy

Q153: The current ratio at the end of

Q174: The company's return on total assets for