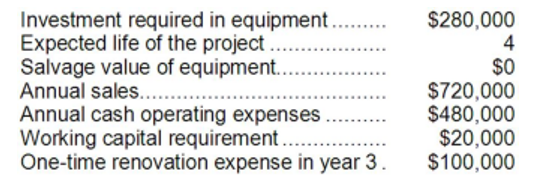

Erling Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

Definitions:

Constant Growth Rate

An assumption in certain financial models that estimates an investment's dividends or cash flows will grow at a steady, unending rate.

Constant Growth Rate

A steady rate at which a variable, such as company earnings or dividends, increases over a specific period.

Required Return

The minimum expected return by investors for investing in a risky asset, taking into account the risk associated with the asset.

Intrinsic Value

The perceived or calculated true value of an asset, investment, or company based on fundamental analysis.

Q1: Illies Corporation's comparative balance sheet appears below:

Q3: The net cash provided by operating activities

Q7: The net cash provided by (used in)

Q32: Plaut Corporation has two operating divisions--a Consumer

Q42: The net present value of the entire

Q43: Charlie Company has provided the following data

Q59: Globe Manufacturing Company has just obtained a

Q99: Hernande Corporation has provided the following

Q149: Bulan Inc. makes a range of products.

Q285: Data from Yochem Corporation's most recent balance