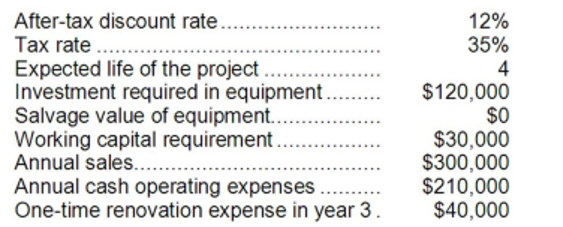

Amel Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

Actual Inflation

The rate at which the general level of prices for goods and services is rising, and subsequently, eroding purchasing power.

Unemployment Rate

The unemployment rate is the percentage of the labor force that is jobless and actively seeking employment.

Expected Inflation

The rate at which the general level of prices for goods and services is anticipated to rise over a specified period.

Actual Inflation

The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling, as it is currently being measured or experienced in the economy.

Q3: (Ignore income taxes in this problem.) Schaad

Q15: Carr Corporation's comparative balance sheet and income

Q34: If a company has computed a project

Q41: In a decision to drop a product,

Q44: The income tax expense in year 3

Q65: The simple rate of return would be

Q90: Rough Corporation's total assets at the end

Q107: Kaeser Corporation's most recent balance sheet appears

Q144: Valdovinos Corporation has provided the following data:

Q155: Roddey Corporation is a specialty component manufacturer