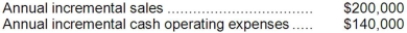

Shaddock Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with a 4 year useful life and zero salvage value. Data concerning that project appear below:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 12%.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 12%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Osteoclasts

Cells responsible for the breakdown and resorption of bone tissue, playing a critical role in bone growth, healing, and remodeling.

Carpals

The eight small bones that make up the wrist, connecting the hand to the forearm.

Clavicles

Long bones that serve as a strut between the shoulder blade and the sternum or breastbone, known as collarbones.

Tarsals

The seven bones in the foot that form the ankle and the back part of the foot arch, contributing to its structure and movement.

Q87: The data given below are from the

Q89: Beacham Corporation's net cash provided by operating

Q104: Tani Corporation's most recent balance sheet appears

Q112: How many minutes of milling machine time

Q141: (Ignore income taxes in this problem.) An

Q142: The net present value of the entire

Q163: Ramon Corporation makes 18,000 units of part

Q184: Lindboe Corporation has provided the following financial

Q214: The company's operating cycle for Year 2

Q273: Sehrt Corporation has provided the following financial