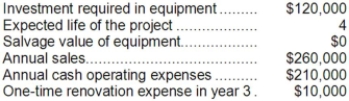

Gloden Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 35% and the after-tax discount rate is 12%.

The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 35% and the after-tax discount rate is 12%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Eating Pattern

The habitual intake of food, including what, when, and how much a person eats over time.

Bipolar Disorder

A psychiatric condition characterized by extreme mood swings between mania and depression.

Questionable Financial Venture

An investment or business opportunity that has uncertain or suspicious legitimacy, potentially leading to financial loss or fraud.

Non-Stop Activity

Continuous engagement in action or operation without any pauses or breaks.

Q5: Santistevan Corporation has provided the following information

Q13: The income tax expense in year 3

Q43: When computing the net cash provided by

Q48: For performance evaluation purposes, how much of

Q59: Leamon Corporation is considering a capital budgeting

Q81: The total cash flow net of income

Q124: (Ignore income taxes in this problem.) Tangen

Q147: Kampmann Corporation is presently making part Z95

Q169: The company's book value per share at

Q260: The company's operating cycle for Year 2