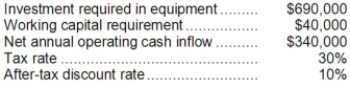

Crabill Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Firms

Firms refer to business entities or organizations that produce goods or provide services with the aim of making a profit.

Industry

A sector of the economy that is made up of manufacturing, production, or provision of services within a specific domain of activity or expertise.

Marginal Revenue

The supplementary income received from the sale of an additional unit of a product or service.

Q17: When a division is operating at full

Q24: The net present value of project Y

Q30: Albertine Co. manufactures and sells trophies for

Q57: A vertically integrated company is more dependent

Q76: A capital budgeting project's incremental net income

Q102: Rank the projects according to the profitability

Q133: What would be the effect on the

Q164: Which product makes the LEAST profitable use

Q182: Part A42 is used by Elgin Corporation

Q200: The accounts receivable turnover for Year 2