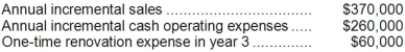

Flippo Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with a 4 year useful life and zero salvage value. Data concerning that project appear below:  An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 6%.

An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 6%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Docket Number

An identification number assigned by a court to a case, used to track and locate court records and proceedings related to that case.

Published Opinion

A formal decision written by a judge or a court of law that is made available to the public.

National Environmental Policy Act

A U.S. environmental law that promotes the enhancement of the environment and established the President's Council on Environmental Quality (CEQ).

United States Code

The codification by subject matter of the general and permanent laws of the United States, organized into titles by topic.

Q2: Service department costs should not be separated

Q12: The net cash provided (used) by financing

Q50: Morbeck Corporation's net income last year was

Q89: If Madison has a limit of 10,000

Q91: What is the differential cost of Alternative

Q99: Hernande Corporation has provided the following

Q103: The net cash provided by (used in)

Q104: The net present value of the entire

Q165: The simple rate of return on the

Q176: The company's current ratio at the end