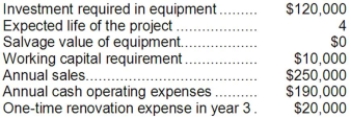

Forehand Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 10%.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 10%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Manufacturing Departments

Specialized sections within a manufacturing facility responsible for different stages of product production, such as assembly, finishing, or quality control.

Machine-Hours

This measure indicates the collective operational duration of machinery used in manufacturing or production processes over a specified timeframe.

Manufacturing Overhead

All indirect costs associated with manufacturing, excluding direct materials and direct labor, such as utilities, maintenance, and factory supplies.

Job-Order Costing System

An accounting system used to track the costs associated with producing specific jobs or batches, useful for customized orders.

Q10: Which of the following is correct regarding

Q19: The fixed costs of service departments should

Q21: On the statement of cash flows, the

Q26: (Ignore income taxes in this problem.) Vernon

Q26: How much Maintenance Department cost should be

Q38: Under the direct method of determining the

Q51: Evita Corporation prepares its statement of cash

Q68: (Ignore income taxes in this problem.) Jason

Q83: The company's net profit margin percentage for

Q169: (Ignore income taxes in this problem.) The