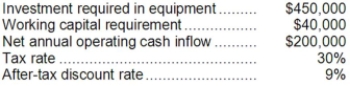

Schlagel Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $150,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $150,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Gradual Changes

Gradual Changes refer to slow and incremental alterations or developments over time in a system, organism, or process.

Abrupt Changes

Sudden and unexpected shifts or transitions, often creating a stark contrast to previous conditions or expectations.

Developmental Changes

Developmental changes refer to the transformation or evolution in physical, cognitive, emotional, and social capabilities and functions over the course of a person's life.

Inherited Personality Traits

Characteristics and behaviors that are passed down from parents to offspring through genetics, influencing an individual's disposition and mannerisms.

Q46: The average collection period for Year 2

Q69: In capital budgeting computations, discounted cash flow

Q72: (Ignore income taxes in this problem.) Veys

Q77: Which of the following is correct regarding

Q82: (Ignore income taxes in this problem.) The

Q114: A project requires an initial investment of

Q123: Narciso Corporation is preparing a bid for

Q200: The accounts receivable turnover for Year 2

Q263: Narstad Corporation's debt-to-equity ratio at the end

Q286: Financial statements for Praeger Corporation appear below: