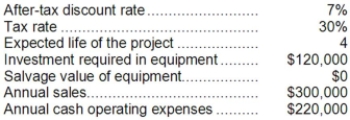

Welti Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $30,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $30,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

Definitions:

Administrative Fee

A charge associated with the management or processing of a service, often added to the cost of transactions or services.

Employment-At-Will Doctrine

A legal rule that an employment relationship can be terminated by either the employer or the employee at any time, for any reason or for no reason at all, unless otherwise legally restricted.

Federal Laws

Legislation enacted by the national government of a country that applies to all regions, states, or territories within that country.

Ethical Perspective

The viewpoint or stance on moral principles and how they should influence behavior and decision-making.

Q4: A product whose revenues do not cover

Q13: Which of the following is correct regarding

Q13: Dorris Corporation's balance sheet and income statement

Q29: (Ignore income taxes in this problem.) Henscheid

Q69: In capital budgeting computations, discounted cash flow

Q100: Marks Corporation's balance sheet appears below: <img

Q114: The working capital at the end of

Q131: An increase in the number of shares

Q162: The sunk cost in this situation is:<br>A)$40,000<br>B)$750,000<br>C)$690,000<br>D)$1,100,000

Q209: Perrett Corporation has provided the following financial